Net Revenue Retention (NRR): A Comprehensive Guide

Introduction to Net Revenue Retention (NRR)

For many companies – especially SaaS businesses – understanding and optimizing financial performance metrics is crucial to driving growth and sustainability. One of the most critical metrics for businesses is Net Revenue Retention (NRR), or net dollar retention. NRR is a measure of how much revenue a company retains from its existing customer base over a specific period, taking into account upgrades, downgrades, and churn. In this guide, we will explore what Net Revenue Retention is, why it is vital for SaaS companies, and how to calculate and improve it.

No matter your industry, Net Revenue Retention is a key metric to understanding business health. In today's competitive market, achieving strong NRR is key to driving growth and long-term success. Many businesses face challenges in maintaining customer loyalty and securing steady revenue, often overlooking potential opportunities for expansion. However, with the right revenue retention solution, companies can not only keep their existing customers but also increase their value over time. In this article, we'll introduce a practical solution to boost your NRR, helping you strengthen customer relationships and accelerate your business growth.

Understanding Revenue Retention Metrics

Revenue retention metrics are crucial for SaaS businesses to measure their ability to retain revenue from existing customers. Net Revenue Retention (NRR) and Gross Revenue Retention (GRR) are two key metrics that help businesses understand their revenue growth, customer satisfaction, and customer retention. NRR measures the change in revenue generated by a cohort of customers over a set period, while GRR measures the amount of recurring revenue retained from one period to another.

Calculating Net Revenue Retention Formula

To calculate net revenue retention (NRR), you need to track monthly recurring revenue (MRR), expansion MRR, churn MRR, and contraction MRR. Lost revenue from customer churn and account downgrades must be subtracted from total revenue to accurately calculate NRR. NRR can be calculated on a monthly, quarterly, or annual basis, depending on your company’s business model and the insights it needs.

The net revenue retention calculation is simple:

NRR = ((Starting MRR + Expansion MRR) - (Churn MRR + Contraction MRR) ÷ Starting MRR) x100

Calculating Gross Revenue Retention Formula

Gross Revenue retention is slightly different. It focuses solely on your ability to retain existing revenue. This is how you can calculate gross revenue retention:

GRR = (Starting MRR – (Churn MRR + Contraction MRR) ÷ Starting MRR) x100

Gross Revenue Retention vs. Net Revenue Retention

Gross Revenue Retention (GRR) measures the ability to retain customers, while NRR measures the ability to retain revenue. Net revenue retention is an important metric that considers upgrades, downgrades, and churn to provide a comprehensive view of revenue retention. GRR only shows the ability to retain customers, while NRR shows the ability to retain and expand contracts. The gross revenue retention formula is:

To break it down:

Renewals

Recurring revenue retained from existing customers at the end of a given period.

Expansion

Additional revenue generated from existing customers, such as through upsells or cross-sells.

Downgrades

Reduction in recurring revenue due to customers opting for a lower-tier plan.

Churn

Loss of recurring revenue due to customers leaving.

An example of how a company can calculate net revenue retention

Example 1

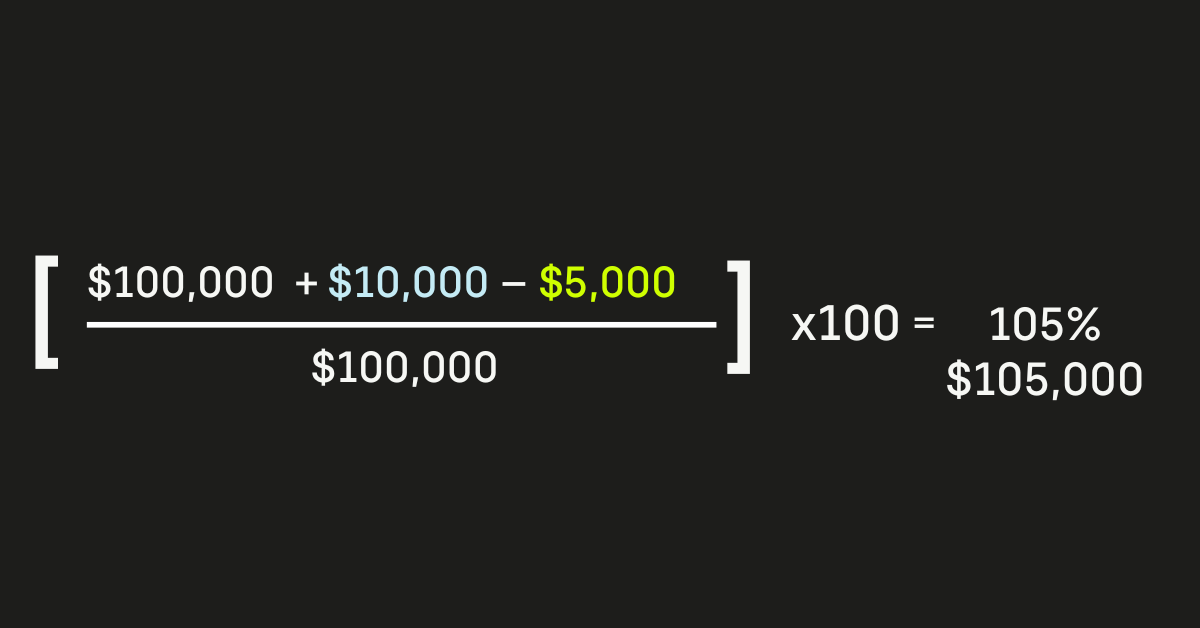

Imagine a SaaS company has $100,000 in monthly recurring revenue (MRR) at the start of January. By the end of January:

- It retains $100,000 from renewals.

- Gains an additional $10,000 from upselling existing customers.

- Experiences $5,000 in churn.

Here is how you would calculate net revenue retention for this example:

([$100,000 + $10,000 - $5,000] ÷ $100,000) x 100 = $105,000 or 105% NRR

An NRR of 105% indicates that the company retains 100% of its recurring revenue

Example 2

Imagine a SaaS company has $100,000 in monthly recurring revenue (MRR) at the start of January. By the end of January:

- It retains $75,000 from renewals

- Gains an additional $10,000 from upselling existing customers.

- Experiences $25,000 in churn.

Here is how you would calculate net revenue retention for this example:

([$100,000 + $10,000 - $25,000] ÷ $100,000) x 100 = $85,000 or 85% NRR

An NRR of 85% indicates that the company retains 85% of its recurring revenue or conversely, that it is losing 15% of it's recurring revenue (when accounting for both expansion revenue and churned customers).

What is a Good NRR for SaaS Companies?

A “good” NRR can vary depending on the industry and company maturity, but generally:

Above 115%

Excellent. This means the company is expanding its revenue base from existing customers, more than offsetting any churn.

100% - 110%

Strong. The company is retaining most of its revenue but may need to focus on reducing churn or increasing upsells.

Below 90%

Needs improvement. The company is losing too much revenue to churn or downgrades, signalling potential customer dissatisfaction or a need to improve the product offering.

Strategies for Improving Net Revenue Retention

If you are wondering how your organization could improve net revenue retention then you should consider how you can reduce churn (and therefore retain customers), how you can identify upsell opportunities and how you can minimize any downgrades.

Reducing Churn

Reducing churn is critical to improving NRR, as it directly affects revenue retention.

- Identify the reasons behind customer churn and address them through improved customer support, product enhancements, and proactive communication.

- Implement a churn prevention strategy to reduce the number of customers lost.

Upselling and Cross-Selling

Upselling and cross-selling can help increase revenue from existing customers, thereby improving NRR.

- Identify opportunities to offer additional products or services that meet the evolving needs of your customers.

- Develop targeted marketing campaigns to promote upselling and cross-selling opportunities.

Limiting Downgrades

Downgrades can negatively impact NRR, so it’s essential to limit them.

- Offer flexible pricing plans and tiered pricing structures to accommodate changing customer needs.

- Implement a downgrade prevention strategy to minimize revenue loss.

Monitoring and Optimizing Monthly Recurring Revenue

Regularly track and analyze NRR to identify areas for improvement.

- Use revenue metrics such as MRR, ARR, and LTV to gain insights into your business’s financial health.

- Adjust your strategies based on the data to optimize NRR and drive revenue growth.

Best Practices for Net Revenue Retention

Focus on delivering exceptional customer experiences to drive loyalty and retention. Monitoring your net revenue retention rate regularly can help identify trends and areas for improvement.

- Continuously monitor and analyze revenue metrics to identify areas for improvement. Incorporating annual recurring revenue (ARR) into your analysis can provide a more comprehensive view of your financial health.

- Develop targeted strategies to reduce churn, increase upselling and cross-selling, and limit downgrades.

Why is NRR Important for SaaS Companies?

Customer Health Indicator

NRR provides insight into how satisfied and engaged your customers are with your product. A high NRR indicates that customers are not only staying but are also increasing their usage or purchasing additional services leading to expansion revenue.

Growth Without New Acquisitions

A strong NRR means a company can grow its revenue without relying solely on new customer acquisitions, which is typically more costly and time-consuming.

Predicts Future Revenue

NRR is a forward-looking metric. It helps SaaS companies forecast future revenue more accurately based on existing customer behavior.

Attracts Investors

Investors often look at NRR when evaluating SaaS companies. A high NRR suggests a stable and growing revenue stream, which is a positive signal for potential investors.

FAQs about Net

Revenue Retention

What is the difference between Net Revenue Retention and Gross Revenue Retention?

Gross Revenue Retention (GRR) measures the percentage of revenue retained from existing customers, excluding any expansion revenue. NRR includes both retention and expansion, providing a more comprehensive view of customer revenue growth.

How often should SaaS companies measure NRR?

It is recommended to measure NRR monthly or quarterly to closely monitor customer behavior and revenue trends.

Can NRR be over 100%?

Yes, if a company generates more revenue from existing customers through upsells and cross-sells than it loses from churn and downgrades, its NRR can exceed 100%.

How does NRR impact a SaaS company’s valuation?

Investors view a high NRR as a sign of a healthy, growing business. A high NRR can positively impact a SaaS company’s valuation by demonstrating a stable and expanding revenue base.

By understanding and focusing on Net Revenue Retention, SaaS companies can drive sustainable growth, reduce churn, and enhance customer satisfaction—all critical factors for success in the competitive SaaS market.

Understanding the Impact of Net Revenue Retention on Customer Lifetime Value (CLV)

Net Revenue Retention (NRR) not only reflects a SaaS company’s ability to retain and expand revenue from its existing customer base but also has a direct impact on Customer Lifetime Value (CLV). CLV measures the total revenue a business can expect from a customer over their entire relationship with the company. A high NRR suggests that customers are likely to stay longer and spend more, thus increasing their lifetime value. For SaaS companies, where growth is often driven by recurring revenue, maximizing CLV through improved NRR is essential. Companies with high CLV can afford to invest more in customer acquisition, knowing they will recoup the costs over a longer and more profitable customer lifecycle.

How NRR Influences Your SaaS Pricing Strategy

NRR plays a crucial role in shaping a SaaS company's pricing strategy. A thorough understanding of NRR allows businesses to evaluate which pricing tiers or product packages are most effective at retaining customers and driving upsells. If a SaaS company notices that customers who start on lower-priced plans are more likely to churn or downgrade, it may consider adjusting its pricing strategy to encourage customers to start on a more sustainable plan. Additionally, insights derived from NRR can guide the development of features and services that add value, thereby justifying price increases and driving higher revenue retention. By aligning pricing strategies with customer value and retention data, SaaS companies can achieve a more balanced and growth-oriented revenue model.

The Role of NRR in Benchmarking and Competitive Analysis

For SaaS companies, Net Revenue Retention is not just an internal performance metric; it also serves as a critical benchmark for competitive analysis. Comparing NRR against industry standards and competitors provides valuable insights into how well a company is retaining and expanding its customer base relative to others in the market. A lower NRR compared to competitors may indicate weaknesses in product offering, customer service, or pricing strategy, prompting a reevaluation of these areas. Conversely, a higher NRR than the industry average can position a company as a leader in customer satisfaction and loyalty. SaaS companies can use these benchmarks to identify growth opportunities, refine their strategic positioning, and enhance their overall market competitiveness.

Hook’s Solution to Net Revenue Retention

Hook enhances your Revenue Strategy. Hook’s solution to revenue retention combines powerful tools to help businesses stay ahead of the game and drive growth. With AI-driven analytics, you can turn your sales data into clear, actionable insights that guide smarter decisions. The platform offers real-time reporting, so you always have up-to-date metrics and performance indicators right at your fingertips. With predictive insights, you can anticipate sales trends and spot new revenue opportunities before your competitors do. Plus, Hook's solution brings everything together with integrated tools that connect your sales and marketing data, making it easier to create a cohesive strategy that boosts revenue retention and sets you up for long-term success.

- AI-Driven Analytics: Transform your sales data into actionable insights.

- Real-Time Reporting: Access up-to-the-minute metrics and performance indicators.

- Predictive Insights: Forecast sales trends and identify revenue opportunities before your competitors.

- Integrated Solutions: Seamlessly connect your sales and marketing data for a unified strategy.

"Hook's allowed us to be more proactive, getting in front of our renewals faster, and to do more with less."

Mastering net revenue retention is crucial for SaaS businesses to drive revenue growth and customer satisfaction. By understanding revenue retention metrics, calculating NRR, and implementing strategies to improve it, businesses can optimize their revenue growth and achieve long-term success.